Education Center

Featured:

What's new:

Spend or Save Graduation Money

Graduation money can be a great head start—but should you spend it or save it? In this blog, we explore your options and help you decide what’s best for your goals, whether it’s investing in your future or treating yourself responsibly.

How to have a Great Summer Vacation – On a Budget

Summer vacation doesn’t have to mean draining your savings or racking up credit card debt. With a little planning in advance, you can have a fun, memory-filled summer vacation, while staying financially sound.

Summer Fun

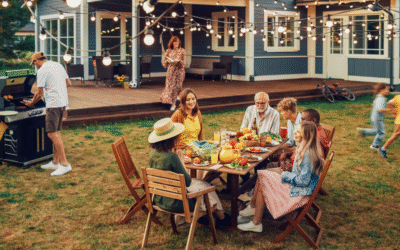

How to have a Great Summer Vacation – On a Budget

Summer vacation doesn’t have to mean draining your savings or racking up credit card debt. With a little planning in advance, you can have a fun, memory-filled summer vacation, while staying financially sound.

Grill & Chill: Summer Cookout Recipes from JVB Employees

Just in time for Memorial Day weekend, our team is sharing their favorite cookout recipes. From strawberry delights to must-try side dishes, you won’t want to miss this tasty roundup!

Fraud

Protecting Seniors from Financial Abuse

Financial exploitation of older Americans is a growing crime in the US. Fraudsters are targeting people of all ages. Preventing elder abuse can be difficult, but is crucial.

How to Recognize a Phone Scam

Scammers have figured out countless ways to cheat you out of your money or identity over the phone. In some phone scams, they act friendly and helpful. In others, they threaten or try to scare you. Read up on how to recognize a phone scam.

How to Protect Your Holiday Cheer from Grinches in Disguise

As the holiday season approaches it brings an increase in scams targeting unsuspecting victims. Here’s 5 tips on how you can stay safe and protect yourself from holiday scams.

Loans

How to Choose the Right Home for You

Before you start shopping, it’s important to know what it is you are looking for in a new home. We have compiled a few items to consider when on the hunt for the perfect house.

Buy Now, Pay Later vs Credit Cards: Which is Right for You?

There are more ways to pay for purchases than ever before. Learn whether buy now, pay later or credit cards is the way to go.

10 Tips for Budgeting Your Holiday Season

As holiday expenses – food, gifts, travel, and more – continue to rise each year, effective budgeting are essential to maintaining financial health into the new year.

Family Finances

Spend or Save Graduation Money

Graduation money can be a great head start—but should you spend it or save it? In this blog, we explore your options and help you decide what’s best for your goals, whether it’s investing in your future or treating yourself responsibly.

How to have a Great Summer Vacation – On a Budget

Summer vacation doesn’t have to mean draining your savings or racking up credit card debt. With a little planning in advance, you can have a fun, memory-filled summer vacation, while staying financially sound.

How to Choose the Right Home for You

Before you start shopping, it’s important to know what it is you are looking for in a new home. We have compiled a few items to consider when on the hunt for the perfect house.